Debt Collection Agency for Beginners

Wiki Article

What Does International Debt Collection Mean?

Table of ContentsSome Known Factual Statements About Dental Debt Collection Examine This Report about Debt Collection AgencyThe Ultimate Guide To Private Schools Debt CollectionThe Main Principles Of Private Schools Debt Collection

The financial debt buyer acquires only an electronic data of details, typically without sustaining proof of the financial debt. The debt is also typically extremely old financial obligation, in some cases referred to as "zombie debt" since the financial obligation purchaser attempts to restore a financial debt that was past the law of restrictions for collections. Financial obligation collection firms may call you either in composing or by phone.

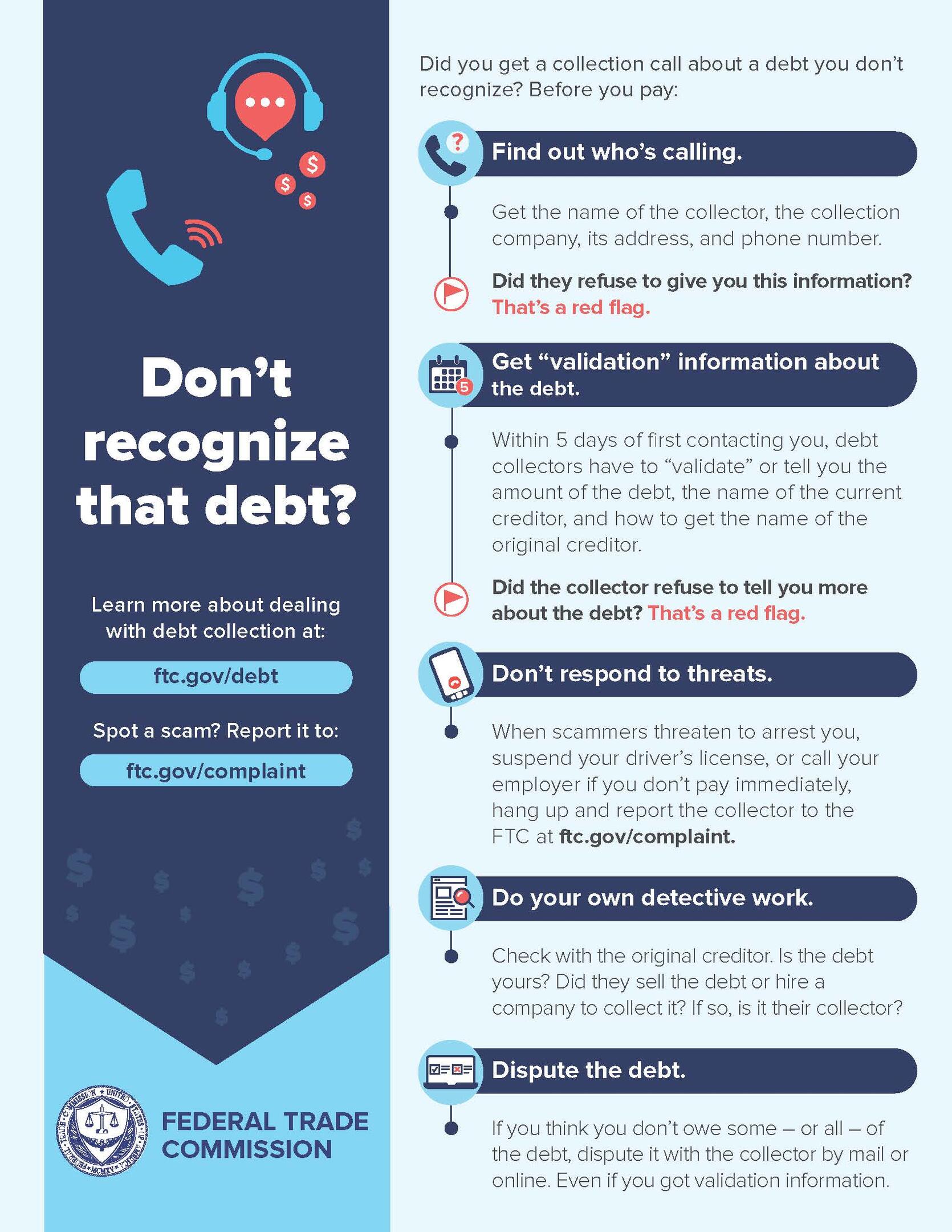

Not talking to them will not make the debt go away, and they might simply attempt alternative techniques to call you, consisting of suing you. When a financial obligation collector calls you, it is essential to obtain some preliminary info from them, such as: The debt collection agency's name, address, and telephone number. The total quantity of the financial obligation they declare you owe, including any type of costs as well as rate of interest charges that might have accumulated.

The Main Principles Of Personal Debt Collection

The letter has to specify that it's from a financial obligation collector. They must also notify you of your rights in the financial debt collection process, and also exactly how you can challenge the financial debt.If you do contest the debt within thirty day, they need to discontinue collection initiatives up until they offer you with evidence that the financial debt is yours. They should give you with the name and also address of the initial creditor if you ask for that info within one month. The financial debt recognition notification must include a type that can be used to contact them if you desire to contest the financial obligation.

Some points financial obligation collection agencies can refrain are: Make duplicated phone call to a borrower, meaning to frustrate the debtor. Intimidate physical violence. Use obscenity. Lie about just how much you owe or make believe to call from a main federal government workplace. Generally, unsettled financial obligation is reported to the credit rating bureaus when it's 30 days overdue.

If your financial debt is transferred to a financial debt enthusiast or sold to a financial obligation purchaser, an entrance will certainly be made on your debt report. Each time your financial obligation is offered, if it remains to go unpaid, one more entry will certainly be contributed to your credit record. Each negative entry on your credit history record can continue to be there for approximately seven years, also after the financial obligation has been paid.

Dental Debt Collection Fundamentals Explained

What should you anticipate from a collection company and also exactly how does the process job? Keep reading to discover out. Once you have actually decided to work with a debt collection agency, make sure you select the best one. If you comply with the guidance listed below, you can be positive that you've employed a respectable company that will manage your account with treatment.Some are much better at obtaining results from larger businesses, while others are knowledgeable at collecting from home-based companies. Ensure you're collaborating with a business that will actually offer your demands. This my website might appear evident, but before you work with a debt collection agency, you require to guarantee that they are qualified and accredited to function as financial debt collection agencies.

Prior to you start your search, comprehend the licensing needs for debt collector in your state. By doing this, when you are speaking with agencies, you can speak intelligently regarding your state's needs. Consult you can try this out the agencies you talk with to ensure they satisfy the licensing demands for your state, especially if they lie elsewhere.

You need to likewise get in touch with your Bbb and the Commercial Collection Company Organization for the names of respectable and also very regarded financial obligation enthusiasts. While you might be passing along these financial debts to an enthusiast, they are still representing your firm. You require to understand how they will represent you, just how they will certainly deal with you, as well as what pertinent experience they have.

The smart Trick of Business Debt Collection That Nobody is Talking About

Simply due to the fact that a strategy is lawful doesn't imply that it's something you want your company name connected with. A reliable financial debt collector will collaborate with you to outline a plan you can deal with, one that treats your former customers the method you 'd intend to be dealt with and also still finishes the job.If that takes place, one method numerous firms utilize is avoid tracing. That suggests they have access to certain databases to help situate a borrower that has left no forwarding address. This can be an excellent tactic to ask about especially. You must additionally explore the collection agency's experience. Have they collaborated with firms in your industry before? Is your situation beyond their experience, or is it something they know with? Relevant experience enhances the chance that their collection initiatives will succeed.

You ought to have a point of contact that you can communicate with and also get updates from. Business Debt Collection. They must have the ability to clearly express what will certainly be anticipated more information from you at the same time, what information you'll need to give, as well as what the cadence and also causes for interaction will be. Your selected firm should have the ability to fit your selected communication requirements, not compel you to approve their own

Ask for proof of insurance from any collection firm to safeguard on your own. Debt collection is a solution, and also it's not an inexpensive one.

Report this wiki page